Information Officer II

Department of Information and Public Relations (GIS)

Telephone: 468-2747

Email: BriaSmith@gov.vg

Press Release

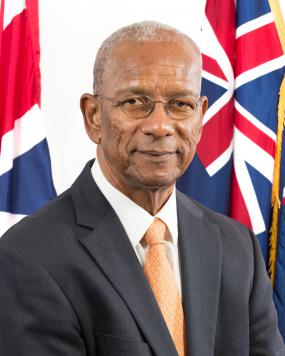

Premier and Minister of Finance, Dr. the Honourable D. Orlando Smith, OBE announced that the BVI has passed important legislation which addresses the European Union’s (EU) concerns over “economic substance” and came into force from January 1, 2019.

Premier and Minister of Finance, Dr. the Honourable D. Orlando Smith, OBE announced that the BVI has passed important legislation which addresses the European Union’s (EU) concerns over “economic substance” and came into force from January 1, 2019.

The Economic Substance (Companies and Limited Partnerships) Act, 2018, concluded its passage through the House of Assembly on December 19. This was ahead of the December 31 deadline set by the EU for the BVI and other financial centres.

The EU is compiling a list of non-cooperative jurisdictions on the basis of certain criteria it has set covering tax transparency, fair taxation and compliance with the OECD’s Base Erosion and Profit Shifting (BEPS) requirements. As part of this process the EU screened 92 countries in 2017, including large nations such as the US and China.

The BVI has already and continues to respond constructively to the EU’s listing exercise. It is expected that the formal response of the EU will not be known for a few months.

Premier Smith said, “The international business and financial services sector makes a vital contribution to the economy of the British Virgin Islands and facilitates cross-border investment and trade to the benefit of the global economy.

The Government has engaged closely with EU officials over the last 18 months to understand and address the concerns that have been raised and has consulted on a regular basis with representatives of the financial services industry. Dialogue with the industry will continue to ensure smooth implementation of the new requirements and the International Tax Authority is issuing a guidance note to accompany the new Act.”

The Premier added, “The Government recognises that the legislation will create challenges for some companies and limited partnerships, especially given the compressed timeline in which we had to pass this legislation. The BVI is not alone in facing these challenges. But in every challenge there is an opportunity and the Government will engage closely with the BVI’s international business and financial services sector to ensure that the jurisdiction continues to provide services that benefit the global economy.”

NOTES:

The BVI Government engaged positively with the EU throughout the screening process. Due to the damage caused by the September 2017 hurricanes, a number of countries/jurisdictions, including the BVI, were given more time to commit to meeting the EU’s concerns. The Council of the EU accepted BVI’s commitment in March 2018.

The BVI meets the EU’s criteria when it comes to transparency, anti-BEPS measures and the general principles of ‘fair taxation’. However, the EU required further assurances from the BVI and other low or zero corporate income tax jurisdictions including Bermuda, the Cayman Islands and the Crown Dependencies on the issue of ‘economic substance’, set out in criterion 2.2 under the heading of ‘fair taxation’. In the BVI’s case it passed the Economic Substance (Companies and Limited Partnerships) Act 2018 to meet these requirements.

Details of the legislation can be found at:

https://eservices.gov.vg/gazette/content/recent-gazettes

A statement by BVI Finance can be found at: http://bvifinance.vg/News-Resources/ArticleID/3001/BVI-Government-Plans-Legislation-to-Address-EU-Concerns-on-Economic-Substance